Medigap (also called Medicare supplement insurance or Medicare supplemental insurance) refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospitals, skilled nursing facilities, home health care, ambulance, durable medical equipment, and doctor charges.

Medigap’s name is derived from the notion that it exists to cover the difference or “gap” between the expenses reimbursed to providers by Medicare Parts A and B for the preceding named services and the total amount allowed to be charged for those services by the United States Centers for Medicare and Medicaid Services (CMS).

Approximately 14 million Americans had Medicare Supplement insurance in 2018, according to a report by the American Association for Medicare Supplement Insurance.

How to compare Medigap policies

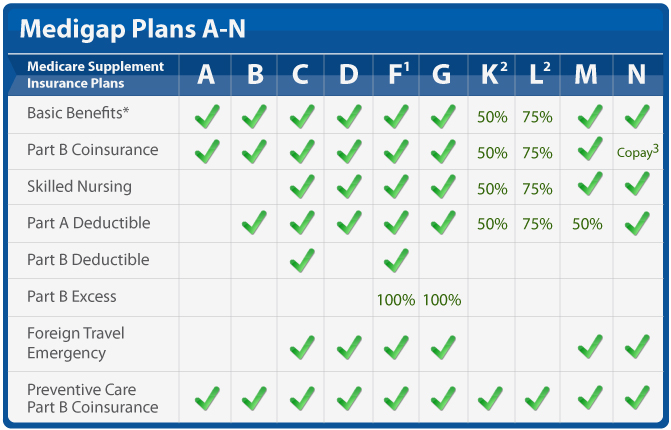

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters.

The most popular Medicare Supplement Plans are Plans F, Plan G, and Plan N.

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

What Does a Medicare Supplement Cost?

The cost of a Medigap plan can vary due to several factors, including the type of plan you enroll in, where you live, and the company selling the plan. You pay a monthly premium for a Medigap policy. A Medigap policy covers only one person. If you and your spouse both want a Medigap policy you will each need to buy one.

Medigap policies are only available to people who already have Medicare Part A, which helps pay for hospital services, and Medicare Part B, which covers the cost for doctor services. People who have a Medicare Advantage plan cannot get a Medigap plan.

Each Medigap policy has a monthly premium. The exact amount can vary by individual policy. Insurance companies can set monthly premiums for their policies in three different ways:

Community rated. Everyone that buys the policy pays the same monthly premium regardless of age.

Issue-age rated. Monthly premiums are tied to the age at which you first purchase a policy, with younger buyers having lower premiums. Premiums don’t increase as you get older.

Attained-age rated. Monthly premiums are tied to your current age. That means your premium will go up as you get older.

Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020. If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans that cover the Part B deductible.

In Los Angeles, most Medigap plans range between $80-$250 per month depending on several factors such as age, location, and the insurance company offering the plan.

The California Birthday Rule

In CA, we have a unique rule that allows us to move our clients between insurance companies for the same plan or one of lesser benefit each year around your birthday, no health questions asked. This allows you, the consumer to take advantage of lower premiums each year.

Medicare Advantage Plans

An alternative to a Medigap plan is a Medicare Advantage plan. Advantage plans combine Medicare A+B into one policy and often add prescription drug coverage and sometimes dental and vision too.

Why Work With Us?

We are completely independent and work with all the top companies and plans in Los Angeles, CA. We are able to compare all plan options and help you pick the plan that fits your unique needs and preferences.

During our initial consultation, we ask what your preferences are such as doctors, hospitals, budget, etc. These are things that help us determine what specific plan is best for your situation. In addition, we help our clients each year when it comes time to review your plan. We charge nothing for our services, we are compensated directly by the insurance companies and it does not affect the premium you pay.

Call us directly today at (213) 214-2399 for a free consultation or use the online form to get started.